£330

Tax Advice Masterclass (Nov/Dec 2025)

The Tax Advice Masterclass will teach you, and other tax professionals, how to provide high-quality tax advice – the type of tax advice that allows clients to make fully informed decisions with ease and helps you to become their trusted tax advisor of choice.

See below for:

- Who the masterclass is for

- Why this course

- What’s included (and costs)

- Dates for live sessions

- Want your employer to pay and attend during work time?

- Modules (complete list)

- What past attendees say

1. Who the masterclass is for

The masterclass is designed for people primarily with two or more years’ tax experience – but ultimately, it’s for anyone who wants or needs to provide high-quality tax advice to clients.

The masterclass will be highly suitable for those who:

- Work in a role where they provide or are involved in providing tax advice

- Want to be involved in more advisory work

- Work in a non-advisory role and want to move, or are transitioning into, an advisory role

If you can demonstrate to your colleagues that you are an asset on advisory work, then you’re much more likely to be involved in advisory work.

From experience, delegating advisory work can be challenging, frustrating and more difficult than not delegating it. But if you know how to provide quality tax advice, you can flip that script, making it easy, straight-forward and timesaving for your colleagues.

This course will help you do exactly that, which should increase the chances of them involving you in advisory work.

People on the previous course included those from 1 year's tax experience all the way to manager level.

2. Why this course?

- Engaging and enjoyable through use of real stories, examples, polls, questions and exercises

- In-class (and suggested homework exercises) to use the material and start developing your tax advisory skills immediately

- Understand what excellent tax advice looks like, the mindset for providing it, and practical steps for how to provide it

- Covers both verbal and written advice

- Accelerate the development of your tax advisory skills – an essential skill in being a tax advisor – and therefore accelerate the progression of your career

- Become more valuable – to your employer and clients

Further details, here

3. What’s Included?

- Two mornings of live webinars, delivered over Zoom – dates/times below

- Ask questions live

- In-class exercises to use the material, with on-hand support, plus suggested homework exercises

- Recordings of the webinars for 3 months after delivery

- Tax Advice Checklist that you can use when establishing tax advice to help make sure the advice is high quality

The cost for the above is £330 per person. Discounts are available for bulk enrolment. Email me at jack@thetaxprofessionalspodcast.com for details.

I can also do exclusive/bespoke classes for employers (including face-to-face), outside of the above. Contact me at jack@thetaxprofessionalspodcast.com to discuss.

4. Dates

The live webinars will be on the mornings of the following dates (starting at 9:00, ending latest 13:00):

- Wednesday 26 Nov 2025

- Wednesday 3 Dec 2025

Sign up to my email list for notifications of future dates.

5. Want your employer to pay & to attend during work time?

I created this to help:

Download the business case

You can give this to your employer to explain the benefits to them. Or if you prefer, you can use it to create your own business case.

6. Modules (complete list)

- Giving a Tax Answer vs Tax Advice

- The Hallmarks of High-Quality Tax Advice

- Bird’s Eye View – The Tax Advice Process for Providing High-Quality Advice

- The Tax Advice Process – Understanding the Client and the Facts

- Tax Advice Process – Identifying the Issues, Relevant Tax Rules, and Implications

- Tax Advice Process – Establishing the Advice to be Provided

- Tax Advice Process – Deciding on the Means

- Tax Advice Process – Drafting the Advice

- Tax Advice Process – Review and Finalisation

- Tax Advice Process – Discussion of the Advice with the Client

- Dealing with Queries or Requests for Advice on the Spot Verbally with Clients

- Advising Where Tax Rules are Ambiguous and You Can’t Provide 100% Certainty

- Tax Advice – Writing Tips

- How to Continue Implementing the Material from this Masterclass to Develop Strong Advisory Skills

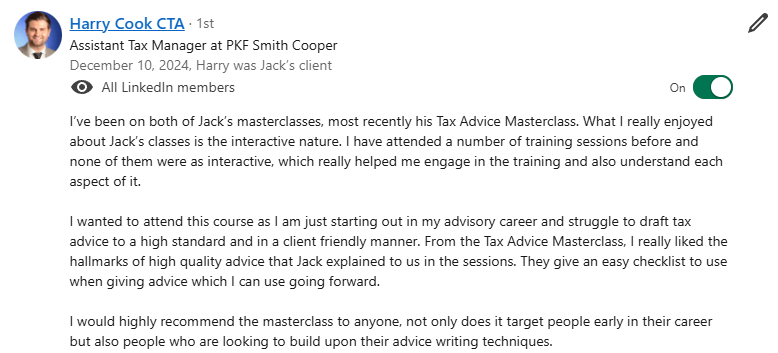

7. What past attendees say

You can see all of these on Jack's LinkedIn profile, under the "Recommendations" section.