£330

Tax Research Masterclass (May 2025)

The Tax Research Masterclass is designed to give you, and other tax professionals, the practical skills to undertake (and document) quality tax research – a fundamental career skill.

See below for:

- Who the masterclass is for

- Why this course

- What’s included (and costs)

- Dates for live sessions

- Want your employer to pay and attend during work time?

- Modules (complete list)

- What past attendees say

1. Who the masterclass is for

The masterclass was created primarily for tax professionals early in their careers (circa 0-5 years). However, it’s for anyone who wants or needs to be better at tax research or be able to find the correct answer to tax questions with confidence.

I often get asked about the 'sweet spot' for enrolling people and to give an idea, here is my answer:

- For those primarily or entirely in compliance roles (typically, this is, for example, personal tax, VAT & CT), just before or after becoming ATT qualified (or equivalent)

- For those primarily or entirely in advisory roles (typically employment tax and some VAT roles), around 6 months after working in tax

Whilst I note the sweet spot, don't rule yourself or others out if you're outside the sweet spot. It's there purely to give you a flavour only. Plenty of students who have been outside of that window have benefitted a lot, including:

- A person who had recently become CTA qualified (and had won numerous awards for their CTA exams!)

- An accountant who moved to tax

- An ex-HMRC tax professional, tax investigator, and policy advisor who moved to the private sector

- A Tax Manager with 14 years' tax experience but primarily in compliance

- An in-house tax professional who wanted to stop going around in circles with their research and be able to document their findings

- Someone who, before working in tax, was a researcher in a biology-related area of science

Hear what 3 past attendees thought, here.

2. Why this course?

- Quickly develop the practical skills to undertake quality tax research and record your findings

- Be comfortable using tax legislation and HMRC guidance

- Be able to use tax case law to support your conclusions and clients

- Become more valuable – to your employer and clients

- Learn to interpret legislation and develop own interpretations to support clients (e.g. with HMRC enquiries)

- In-class exercises to implement the material, plus suggested homework exercises

- One-on-ones with me for bespoke support (if added to package)

3. What’s Included?

- Two mornings of live webinars, delivered over Zoom – dates/times below

- Ask questions live

- In-class exercises to implement the material, with onhand support and live feedback privately to you

- Suggested homework exercises to further implement

- Recordings of the webinars for 6 months after delivery

- PDF of key tax legislation, HMRC guidance, and resources to use in your tax research

The cost for the above is £330 per person.

You can add on one-on-one sessions with me which could cover coaching, mentoring, or other bespoke support from me in relation to tax research – of 30 mins each.

Contact me at jack@thetaxprofessionalspodcast.com if you're an employer interested in a bespoke package.

4. Dates

The live webinars will be on the mornings of the following dates (starting at 9:00, ending latest 13:00):

- 21 May 2025 (first half of course)

- 28 May 2025 (second half of course)

Sign up to my email list for notifications of future dates.

5. Want your employer to pay & to attend during work time?

I created this to help:

Download the business case

You can give this to your employer to explain the benefits to them. Or if you prefer, you can use it to create your own business case.

6. Modules (complete list)

- The Tax Research Process – Bird’s Eye View

- Note-Taking When Doing Tax Research

- The Tax Research Process – Establishing the Scope

- Types of Information Sources and Available Resources

- The Tax Research Process – Finding Relevant/Applicable Information

- Tax Legislation Fundamentals

- Tax Legislation – How to Find Relevant Legislation and Relevant Info Within

- HMRC Guidance Fundamentals

- HMRC Guidance – How to Find Relevant Guidance and Information Within

- Case Law Fundamentals

- The Tax Research Process – Analysing/Interpreting Information

- The Tax Research Process – Documenting Your Research

Note: module 5 covers advice about where to start your research, which I know is an area many people find difficult. It's because there are many choices and this can make it overwhelming.

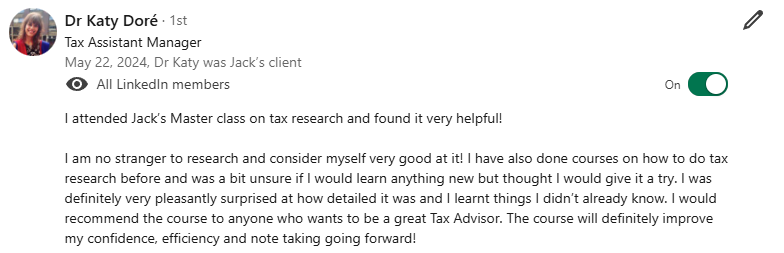

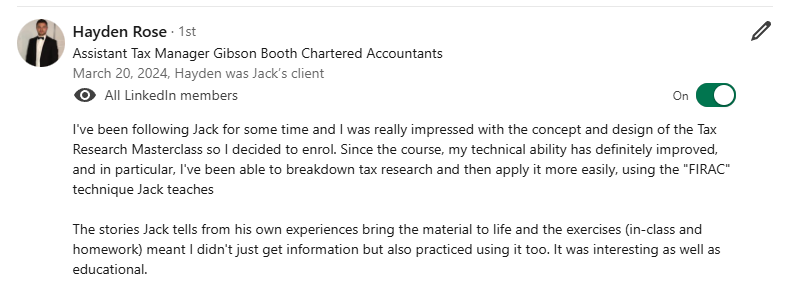

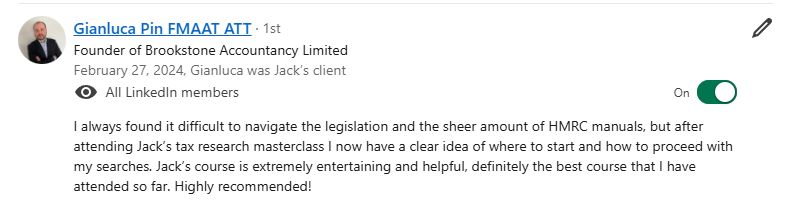

7. What past attendees say

You can see all of these on Jack's LinkedIn profile, under the "Recommendations" section.